Company attributes

Venture Capital Firm attributes

Other attributes

Altos Ventures is a first-stage venture capital firm. The firm has been the first and lead investor in over 50 high-growth technology companies. More than a dozen of these companies were incubated by Altos and started from scratch.

Altos Ventures competes with Alloy Ventures, Accel, and Sequoia Capital.

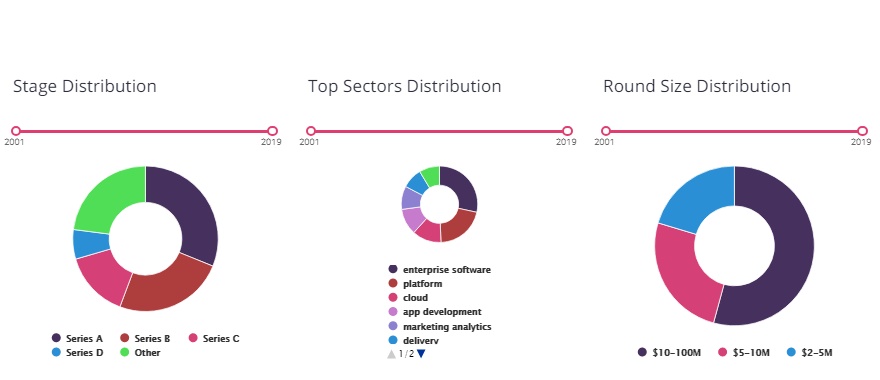

Altos Ventures specializes in making direct and fund of fund investments. It makes venture capital investments in seed/startup, early venture, mid venture, and late venture companies.

Altos Ventures was founded in 1996 by Han Kim and Ho Nam and is headquartered in Burlingame, CA with an additional office in Seoul, South Korea. Altos has been investing in cloud-based business software companies since 1999.

Altos Ventures invests in fast-growing software, mobile, and Internet companies at the initial scale, typically over $1 million in revenue. The firm invests actively across North America and has a dedicated fund focused on South Korean companies. Altos aims to provide a company's first institutional capital and will invest up to $10 million over the life of the company. Its typical initial investment ranges between $1-5 million, for which they seek a meaningful ownership stake.

They make venture growth investments in enterprise and consumer software companies, with particular expertise in SaaS and consumer mobile. They prefer to be the first institutional investor in high-growth, founder-led companies.

They are investing from 2017 and 2018 vintage funds, one focused in North America and the other in Asia. Their active portfolio companies generate more than $7 billion dollars of annual revenue and they employ more than ten thousand people across a dozen countries.

Altos Ventures has had 16 exits. The firm's most notable exits include Piqora, Outspark, and OtherInbox. The firm has raised a total of $324.9M across 6 funds, one of them being Altos Ventures Korea Opportunity Fund II. This fund was announced on Mar 16, 2016, and raised a total of $110M.

The company invests in venture capital funds and commercial printing, diversified support services, educational curriculum development, environmental and facilities services, outsourced client support and customer services, video equipment, internet advertising, digital television, music services, online hobbies, games and toy retail, online music retail, search engine software, e-commerce software, network management software, content management software, online bill payment services, online education courses, online supply chain management, services outsourcing, networking services, video software, financial software, internet marketing automation software, payment and pos processing software, supply chain management software, systems software, educational and training software, telephone equipment, mobile telephones, mobile messaging, outsourced technology manufacturing services, digital, two-way mobile data services, security and alarm services, consumer digital lending, and commercial digital lending sectors.

Altos Ventures focuses on young technology companies and entrepreneurs. Altos invests in all sectors of the IT industry including software, services, digital media, and infrastructure. The firm can invest up to $10 million and has no minimum. Initial investments are typically $1 to 3 million. The firm prefers to own a meaningful minority stake, usually over 20%. Since 1996, Altos has formed six venture capital funds ranging in size from $50 million to $100 million.

They often provide a company’s first institutional capital and will invest up to $10 million over the life of the company. They typically take an active board role in helping founders to scale their teams and companies. They are especially active in the early years of the partnership with founders.